Corner Bakery

STI: PopStats™ Helps Corner Bakery Open 3 Dining Concepts

Corner Bakery

STI: PopStats™ Helps Corner Bakery Open 3 Dining Concepts

Holland Burton started using STI: PopStats in her role as VP of Real Estate at Corner Bakery in 2015. But nearly five years later, she’s still finding new variables she didn’t know existed in the data product. For example, one of the datasets she recently discovered in PopStats was STI: LandScape’s 15 neighborhood segmentation categories.

“I found the data by accident when I was looking for other variables. When I dove into the LandScape categories, I realized that these were variables we could definitely use for our affiliate company restaurants, Il Fornaio, especially as it relates to their new small-plate concept stores Osteria del Fornaio,” explains Holland, who handles site selection and analysis for both Corner Bakery and Il Fornaio, which is affiliated with Corner Bakery through its parent company Roark Capital.

The restaurant company currently operates 18 Il Fornaio Italian and 2 Canaletto Ristorante restaurants in California, Nevada, and Colorado. Il Fornaio has been looking for new locations for new Osteria del Fornaio restaurants, as well as for the signature Il Fornaio Trattoria brand. The Osteria del Fornaio concept is a smaller footprint than the Trattoria brand. It will offer small plates, with a focus on handmade pizza and pasta, as well as a significant attention on craft cocktails.

Holland also continues to look for new locations for Corner Bakery Café, which is a fast-casual bakery café concept offering kitchen-crafted options for breakfast, lunch, and dinner, as well as fresh bakery options available throughout the day. In her role as VP of Real Estate, Holland conducts the research needed to find ideal locations for these three wide-ranging concepts — with over 200 stores from coast to coast.

Landing on LandScape

With over 2,000 variables in the PopStats dataset, Holland says she often finds herself searching through the files just to see what new information she can use to help support her site selection recommendations for three vastly different dining concepts.

“If I can enhance my location research presentations with additional data points for our executive team meetings, so much the better. I will feel more confident in the sites being presented, the executive team will have a stronger understanding of why I’m recommending specific locations, and ultimately that will improve their approval rate of new recommended locations,” she explained.

The company has already negotiated its first real estate lease for the new Osteria del Fornaio concept, and has additional locations in the pipeline for the initial rollout. To select each site, the company relied on LandScape data all the way through the site selection process.

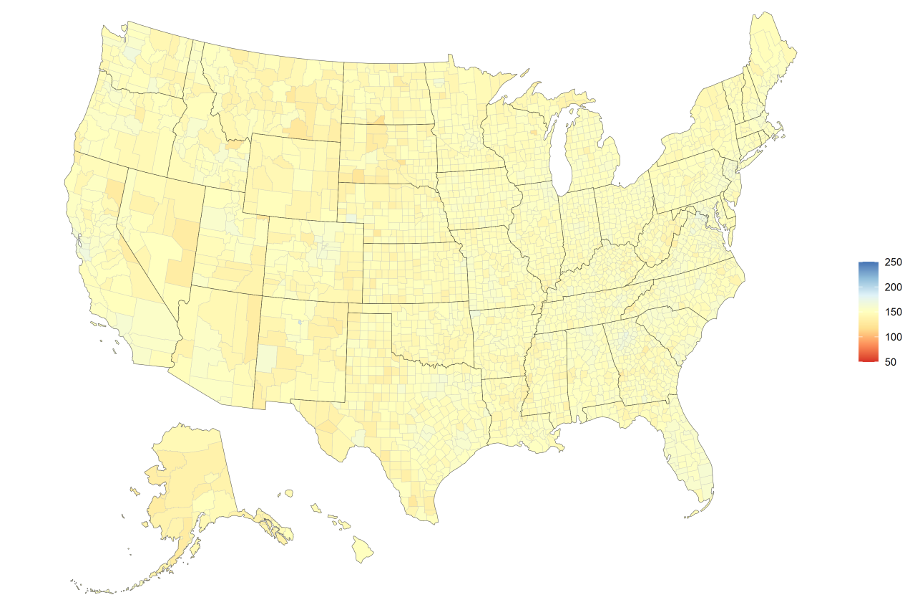

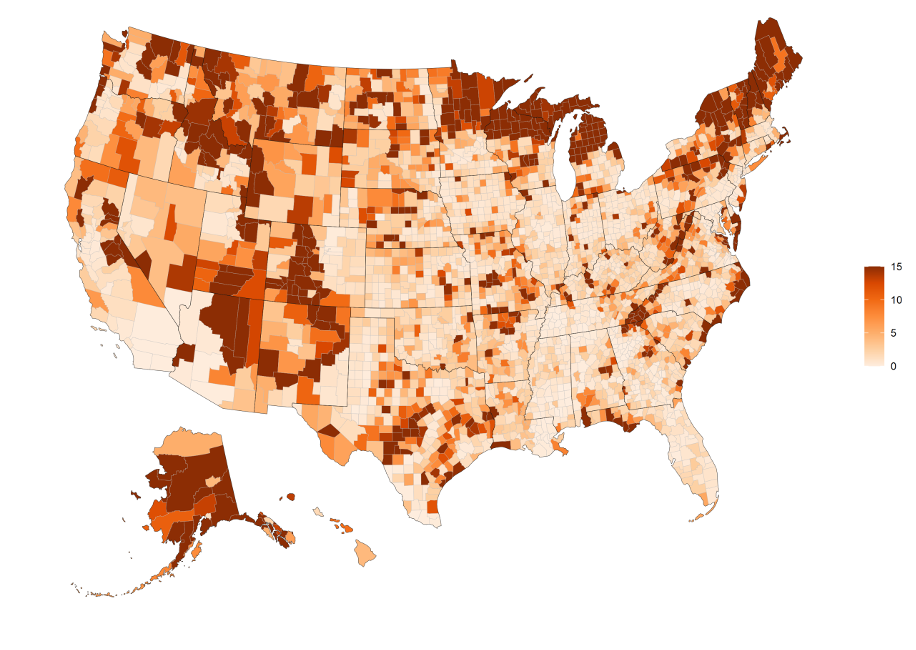

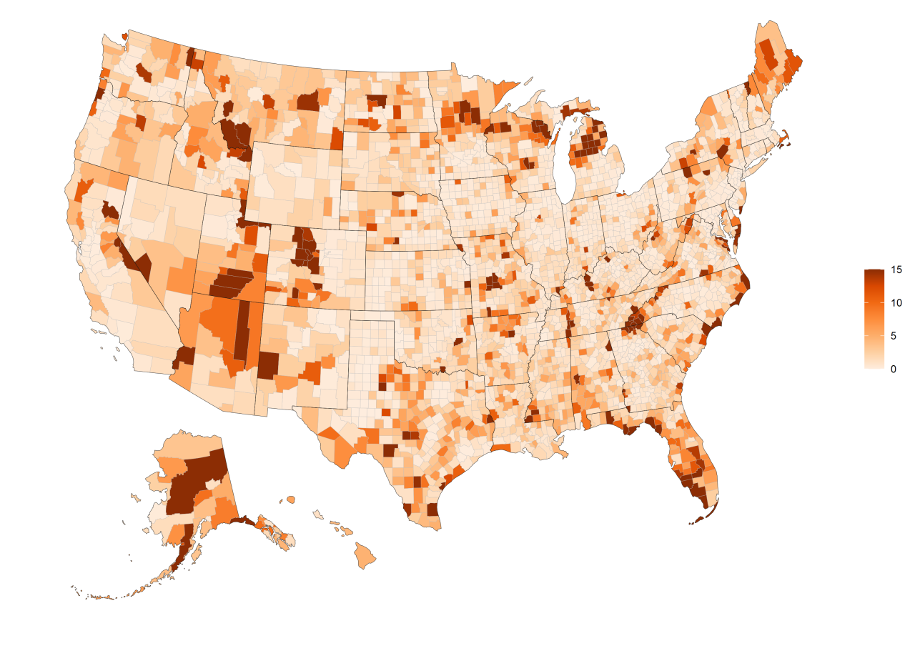

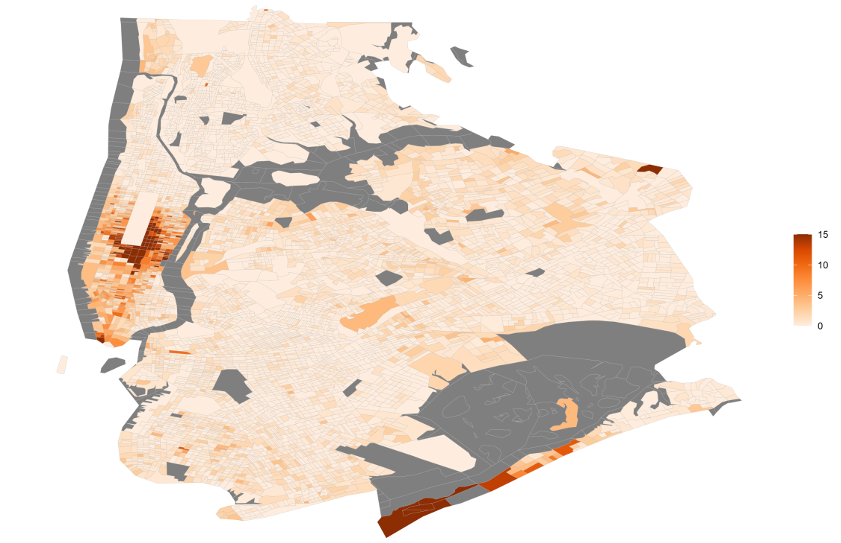

“These establishments will be designed to appeal to a younger crowd,” said Holland. “In fact, we’ve already discovered exactly which LandScape categories we need to attract: Thriving Alone and Single in the Suburbs. The consumer characteristics of those two categories, including income, education, and spending habits, correspond perfectly with what we’ll be offering in the Osteria del Fornaio concept. Although this group is considered a target demographic, of course, the concept welcomes potential customers from all demographic categories.”

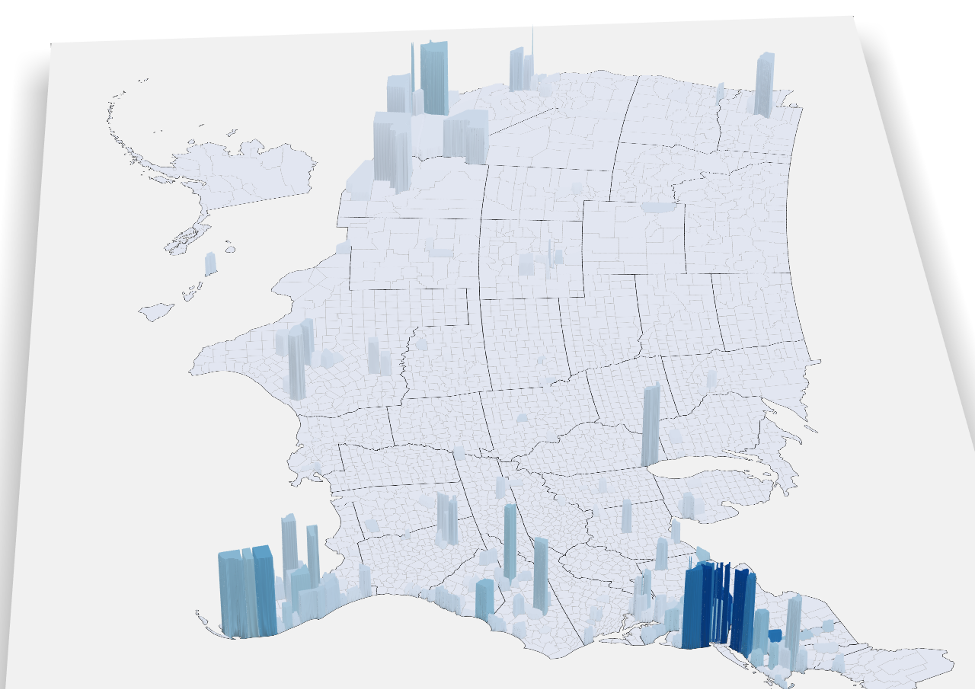

Claim Your Corner

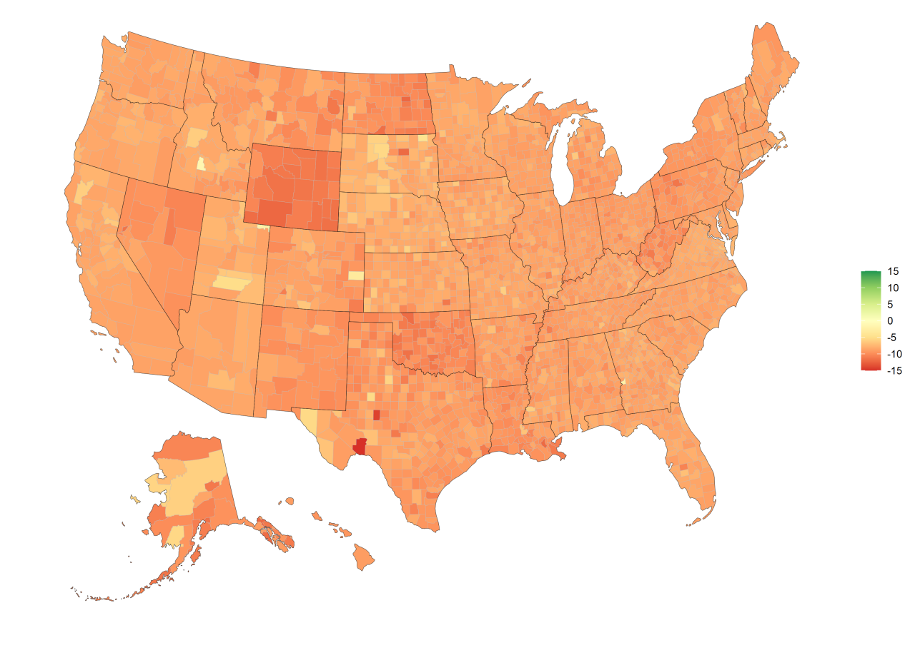

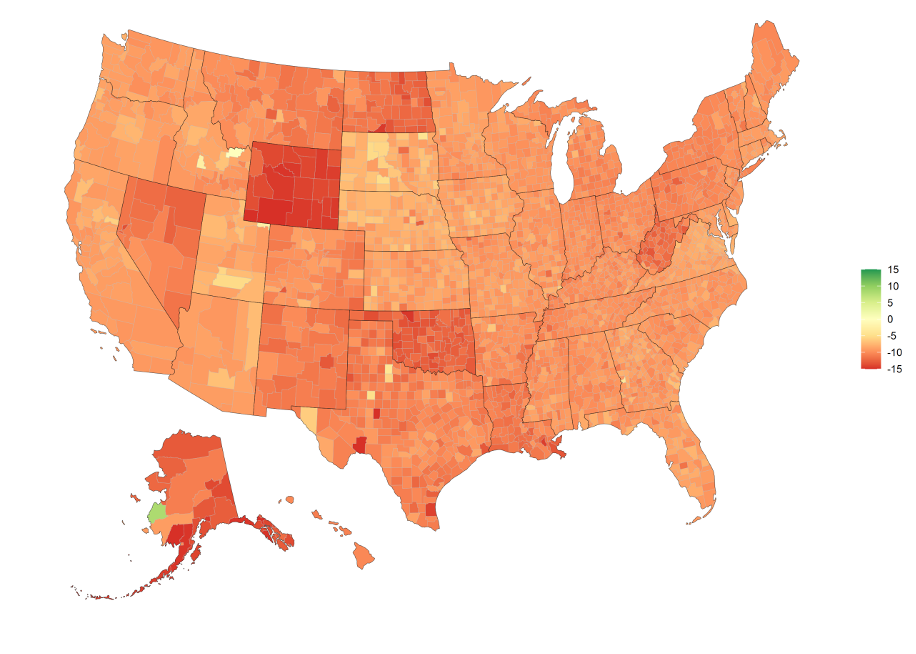

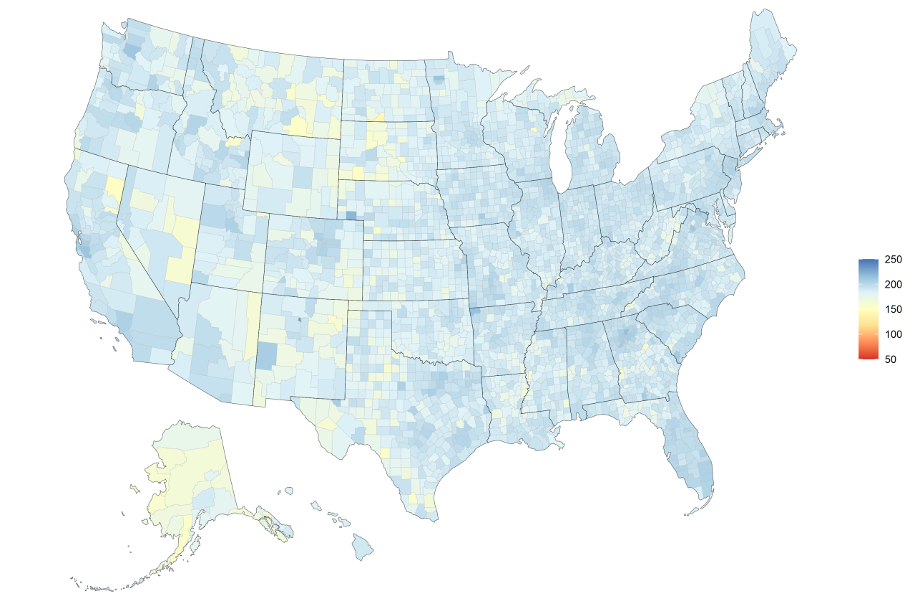

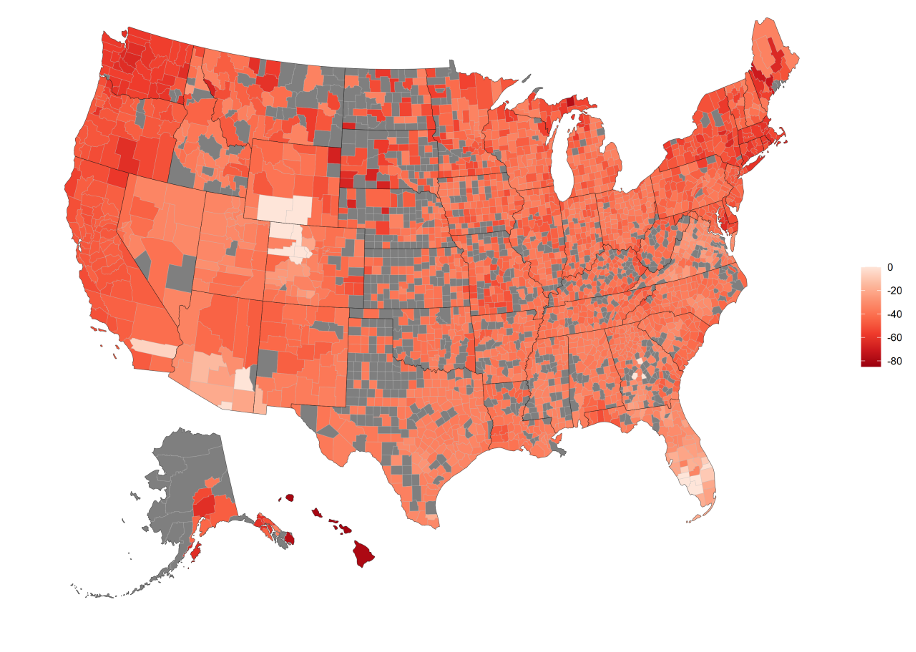

Prior to assisting the Il Fornaio brands with their site selection criteria, Holland first relied on a wide range of PopStats data to find ideal locations for new Corner Bakery Café locations. Among the most relevant to these sites are current year estimates and household data. But another key variable is transient populations, because the seasonal flow of diners in and out of its trade areas directly impacts the café’s success.

“Understanding the flow of the seasonal populations in trade areas has been somewhat critical in getting our new sites through the corporate approval process,” notes Holland. “In one case, we had chosen a location with a suburban-urban feel, but that also had hotels. However, because it had a lot of permanent housing, upper-level management didn’t think it had enough seasonal traffic.

“Thanks to PopStats transient data (which is provided in the Current Year Estimates Quarterly Historicals and Statistics report option), we were able to provide exact numbers on the flow of seasonal traffic quarter by quarter every year. Being able to show the actual versus perceived population counts put the seasonal ebbs and flows into perspective for our decision makers. As a result, we felt very confident that the area had a solid residential base, along with a good transient population coming into the area on a daily basis throughout the year.

“Having researched this information in advance, I had an answer at a moment’s notice as it related to the transient versus permanent population in the trade area. As a result, we were able to get approval to finalize that lease.”

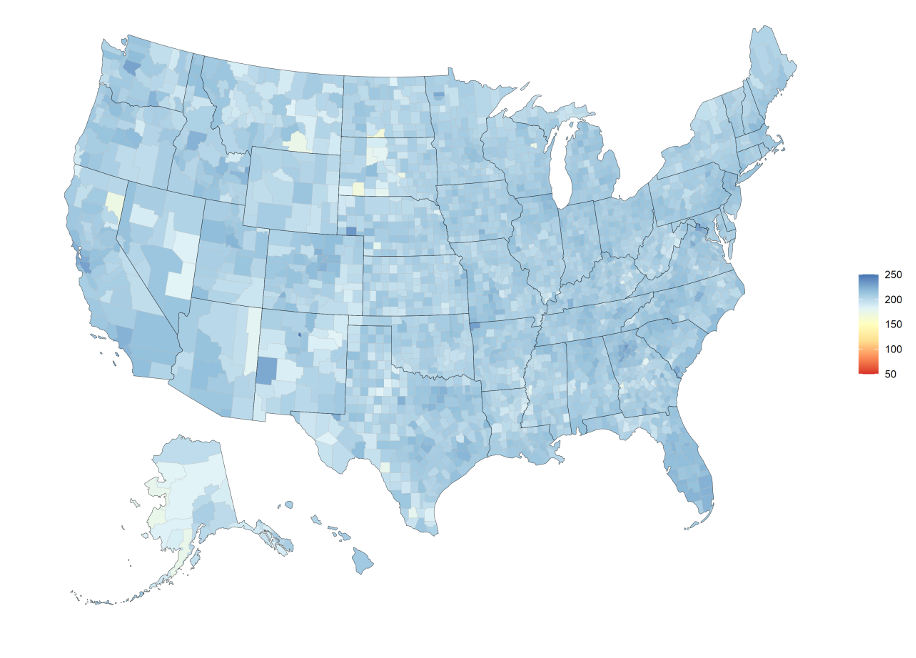

Another unique aspect of the Corner Bakery Cafe concept is that the restaurants offer catering. As a result, another dataset within PopStats that has become valuable for the company is STI: WorkPlace. This data provides key insight into specific trade areas that can directly support the catering aspect of the operation, such as local employment, white- versus blue-collar jobs, the percent of people in the labor force, and the percent of people unemployed.

Gold Standard in Demographic Data

PopStats data also feeds Corner Bakery Café’s analog spreadsheet, which allows for easy comparisons of the demographic characteristics of new sites to all existing cafes that are open and operating. The company uses this as the backbone of its research for five to ten new store locations every year, as well as for understanding renewals and for insights into the growing third-party delivery business.

“This is critical to our real estate research operation because we need to know that the data we input is reliable,” explained Holland. “We are very picky with our locations and like to operate on the side of caution, but also be ahead of the curve. So, feeling confident in the data plays well in our approach to growth. Data is not always an exact science, but PopStats comes as close to exact as any market researcher is going to find.”

Holland said she’s grown even more confident with PopStats data after attending the PopStats Research Conference in April 2019. “I knew that the dataset was different than other demographic data products, but now I understand why thanks to the PopStats’ team’s explanation of the methodology behind it.

“Until I heard Robert’s talk on the methodology, I had not realized all of the processes that go into creating and verifying the dataset. It’s a strong methodology. Now I know why my peers in the industry consider PopStats the Gold Standard in demographic data. Knowing more about the methodology has made me feel even more confident when I go into meetings with our executive team and recommend new restaurant locations.”

While having confidence in the data supporting her store location recommendations has always been important, it’s even more critical now that “we are so far out from the 2010 U.S. Census,” notes Holland. “Typically, the data gets weaker the further out we are. But not PopStats. It’s staying strong and dependable to the very end.”