Housing

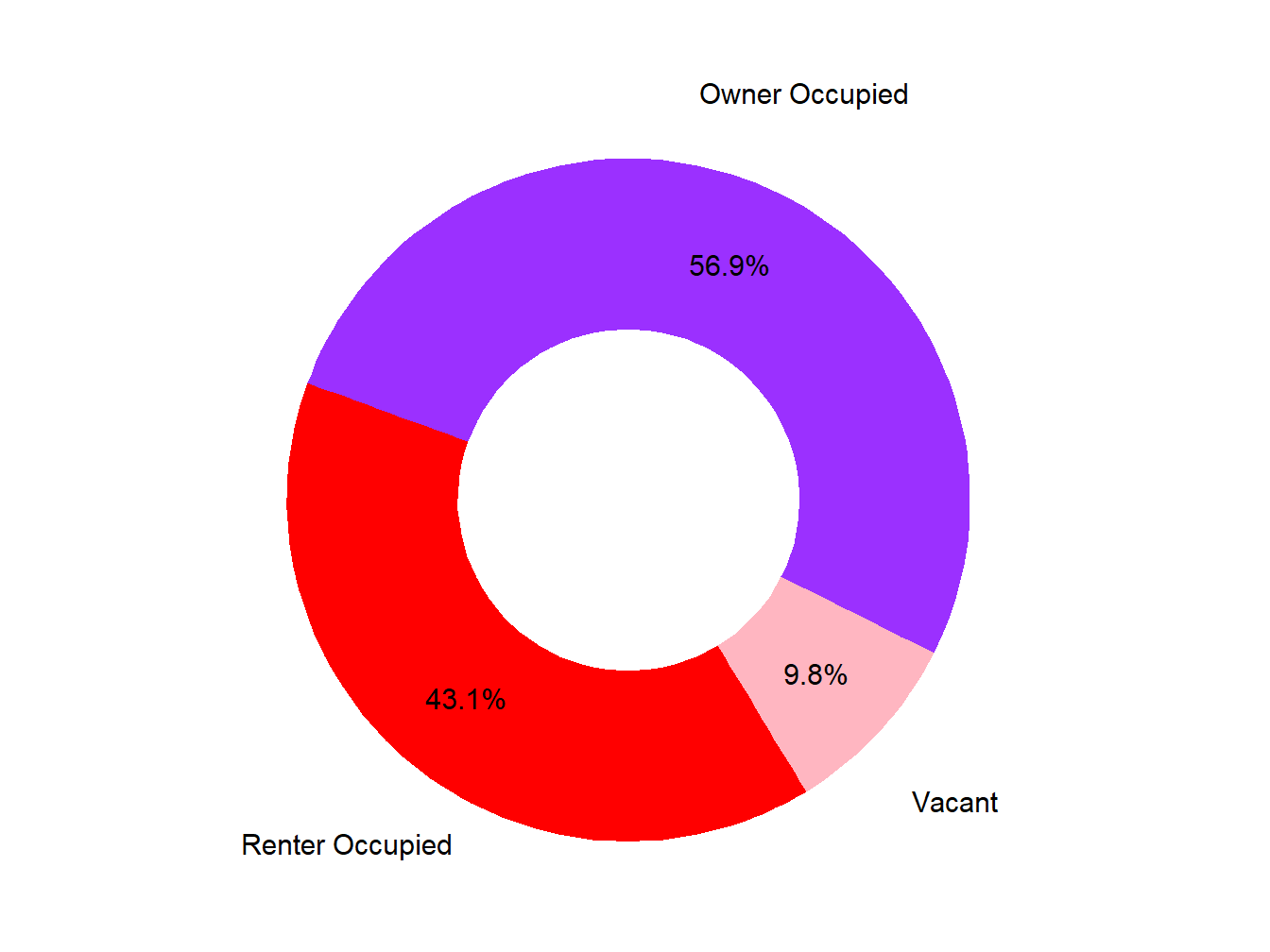

Vacancy - 9.8%

The Las Vegas, NV-AZ Market ranks 96th in Vacancy across STI Markets with a Vacancy rate of 9.8%. That is 112,226 Vacant Housing units compared to 1,033,200 Occupied units.

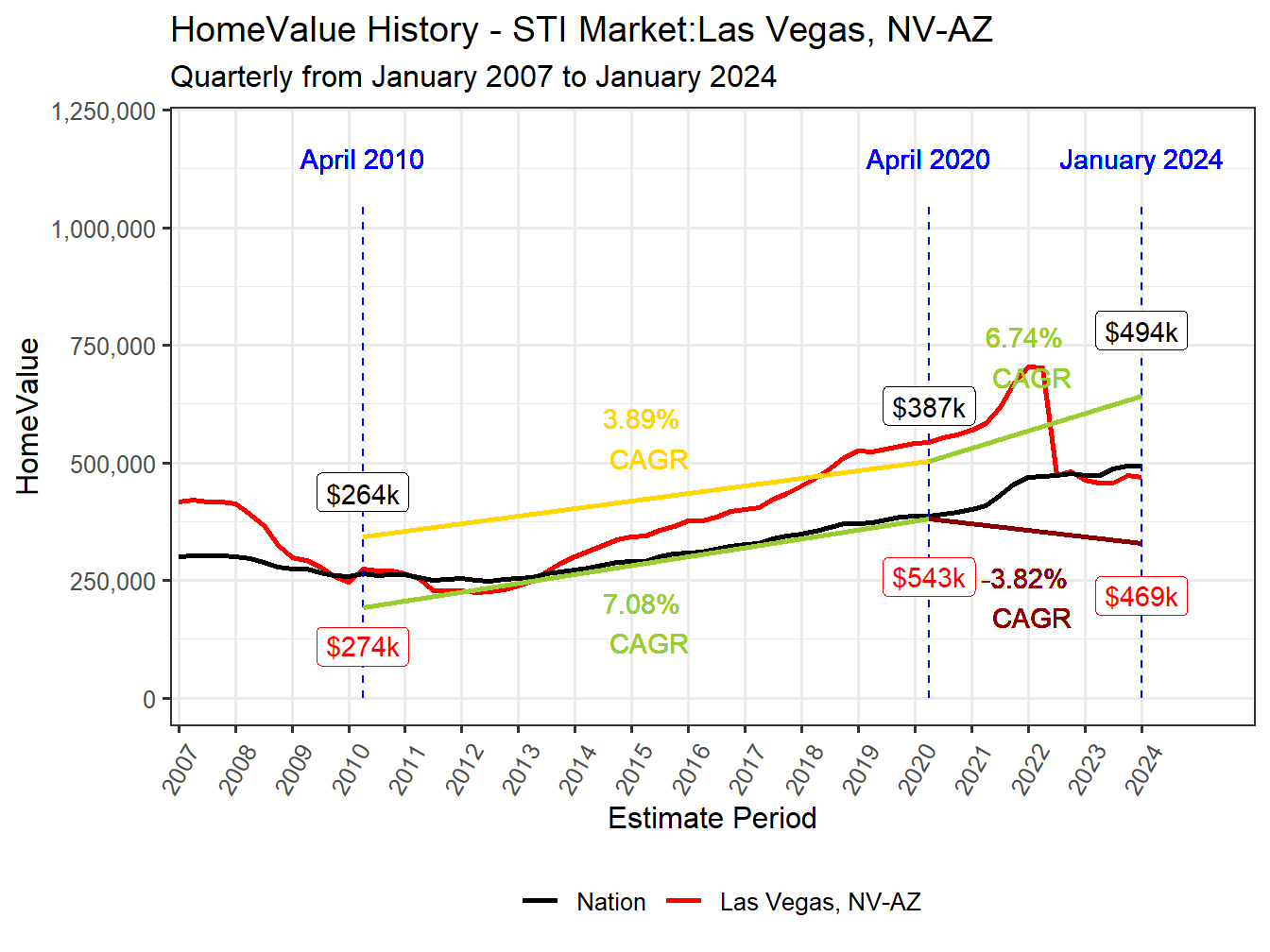

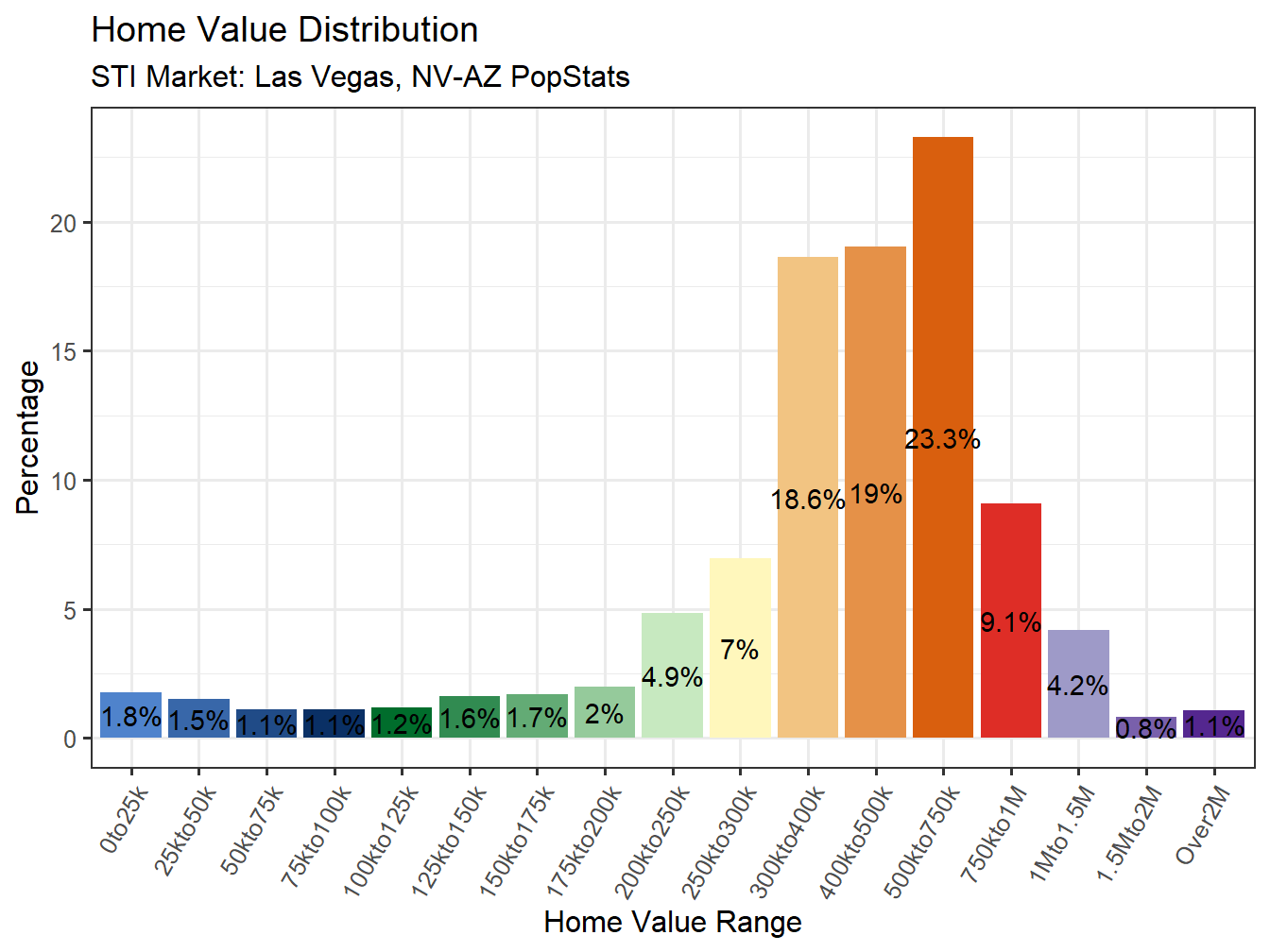

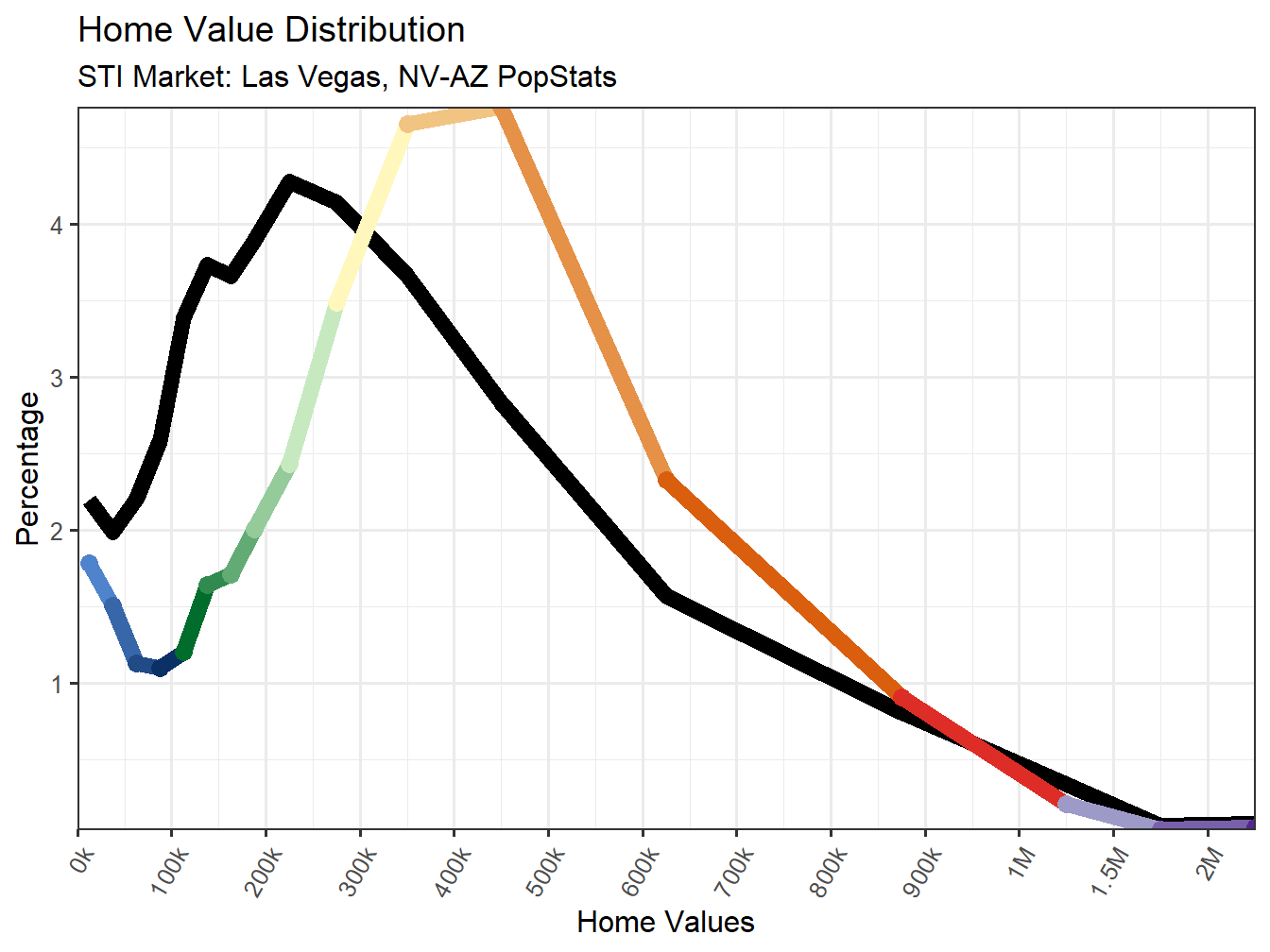

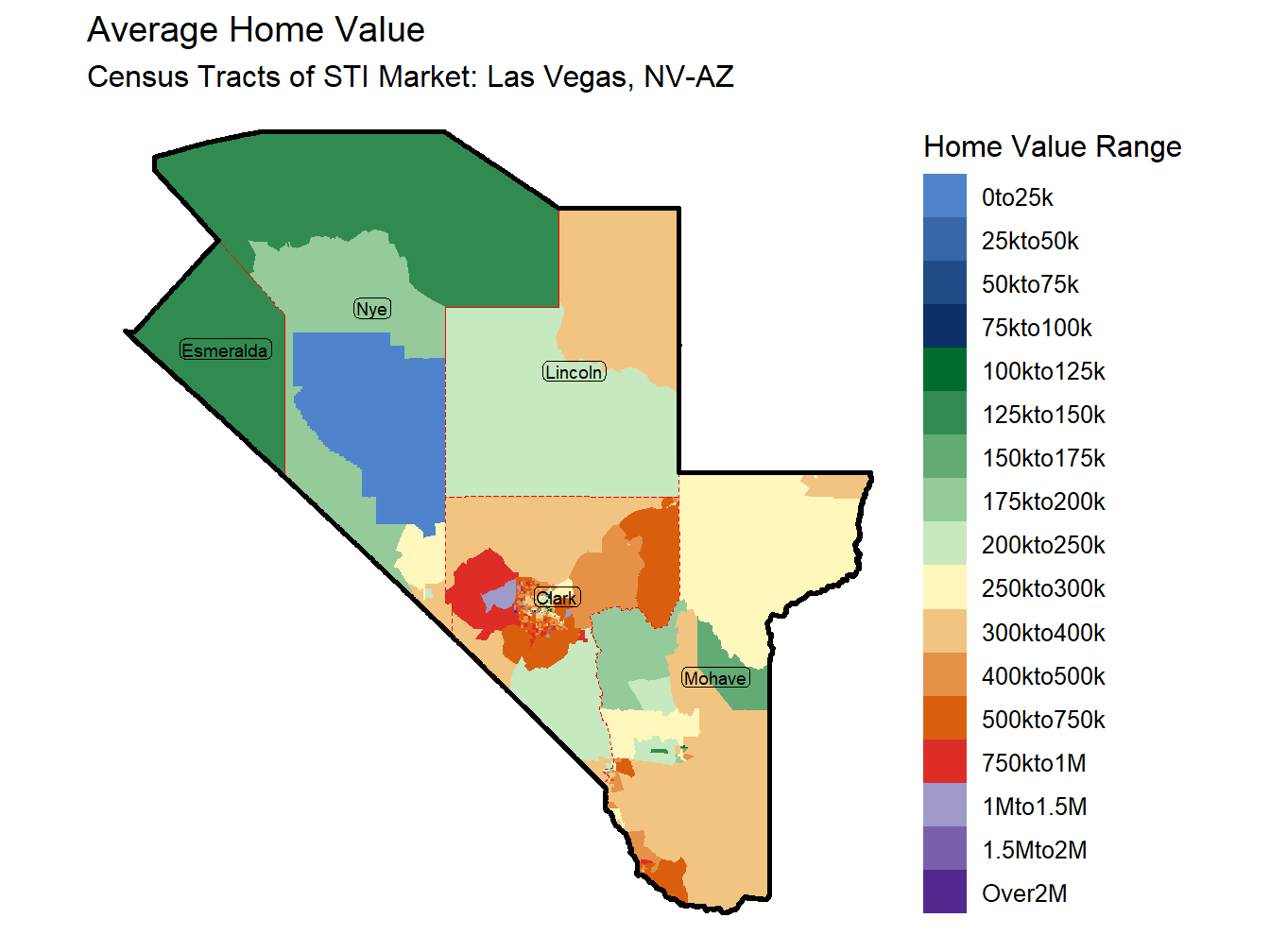

Average Home Value - $552,004

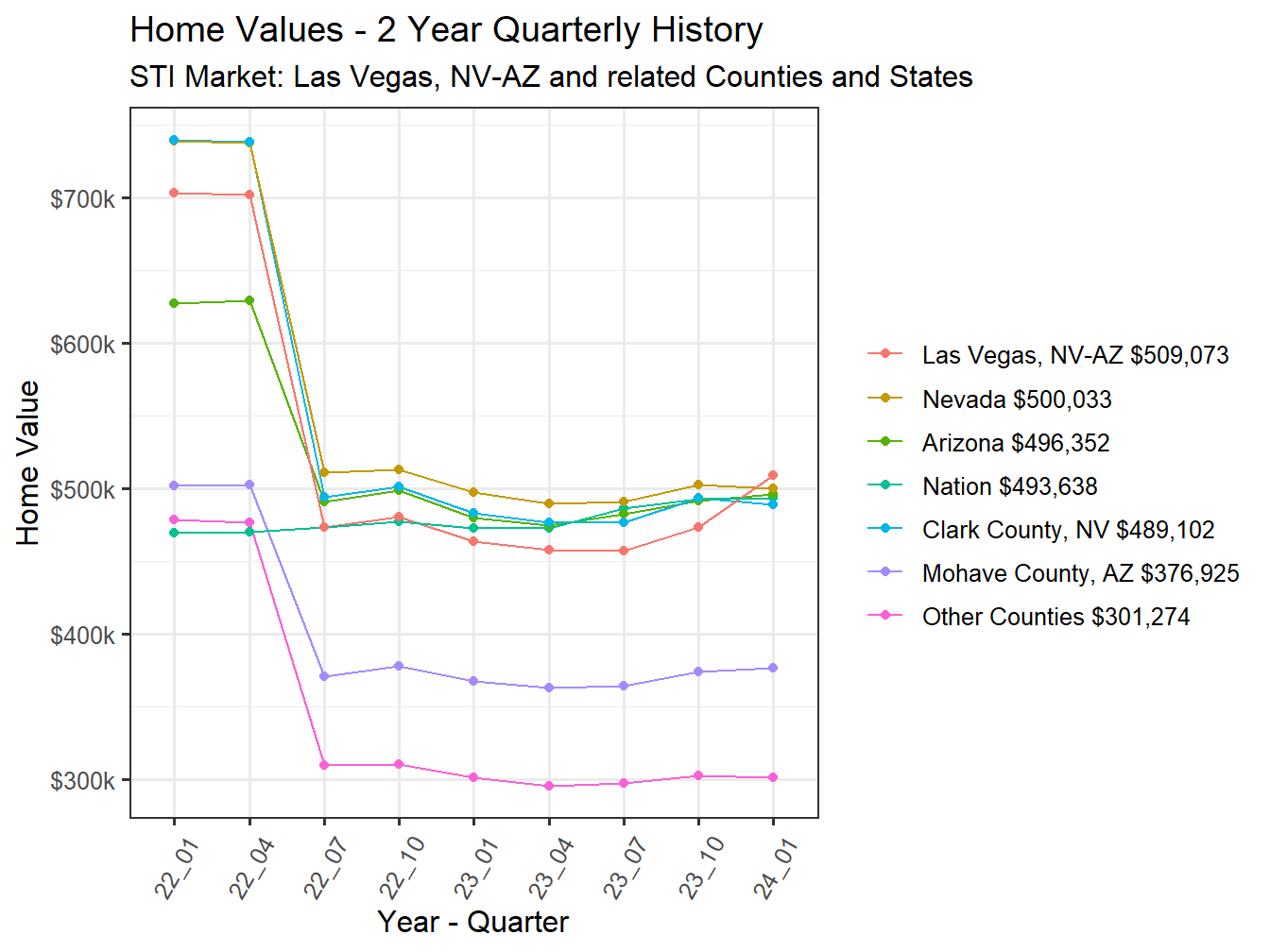

The Average Home Value for owner occupied housing units in the Las Vegas, NV-AZ Market is $552,004. This ranks 28th across STI Markets. Over the last 2 years there has been a change of 13.2% in this markets Average Home Value, compared to a national change of 11.8%. This 2 year change in home values ranks 68th across STI Markets.

Figure 55: Home Value 2year History

Mortgage Risk Level - High

Mortgage Risk is defined as the ratio of recent residential loan amount to income for new home purchases. The Mortgage Risk for the Las Vegas, NV-AZ Market is 3.9. The market subsequently ranks 12th across STI Markets. This is considered to be a High level of mortgage risk.

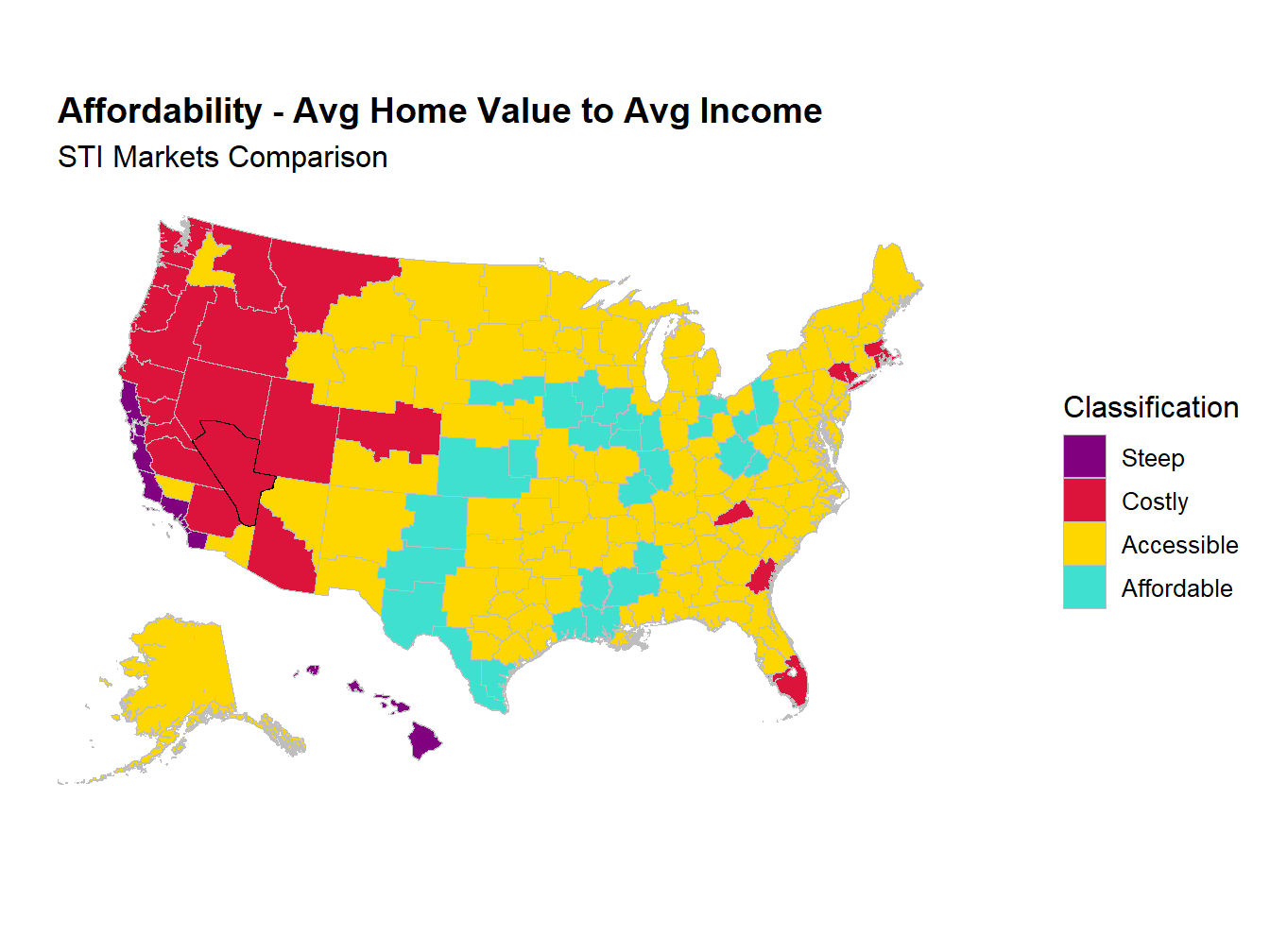

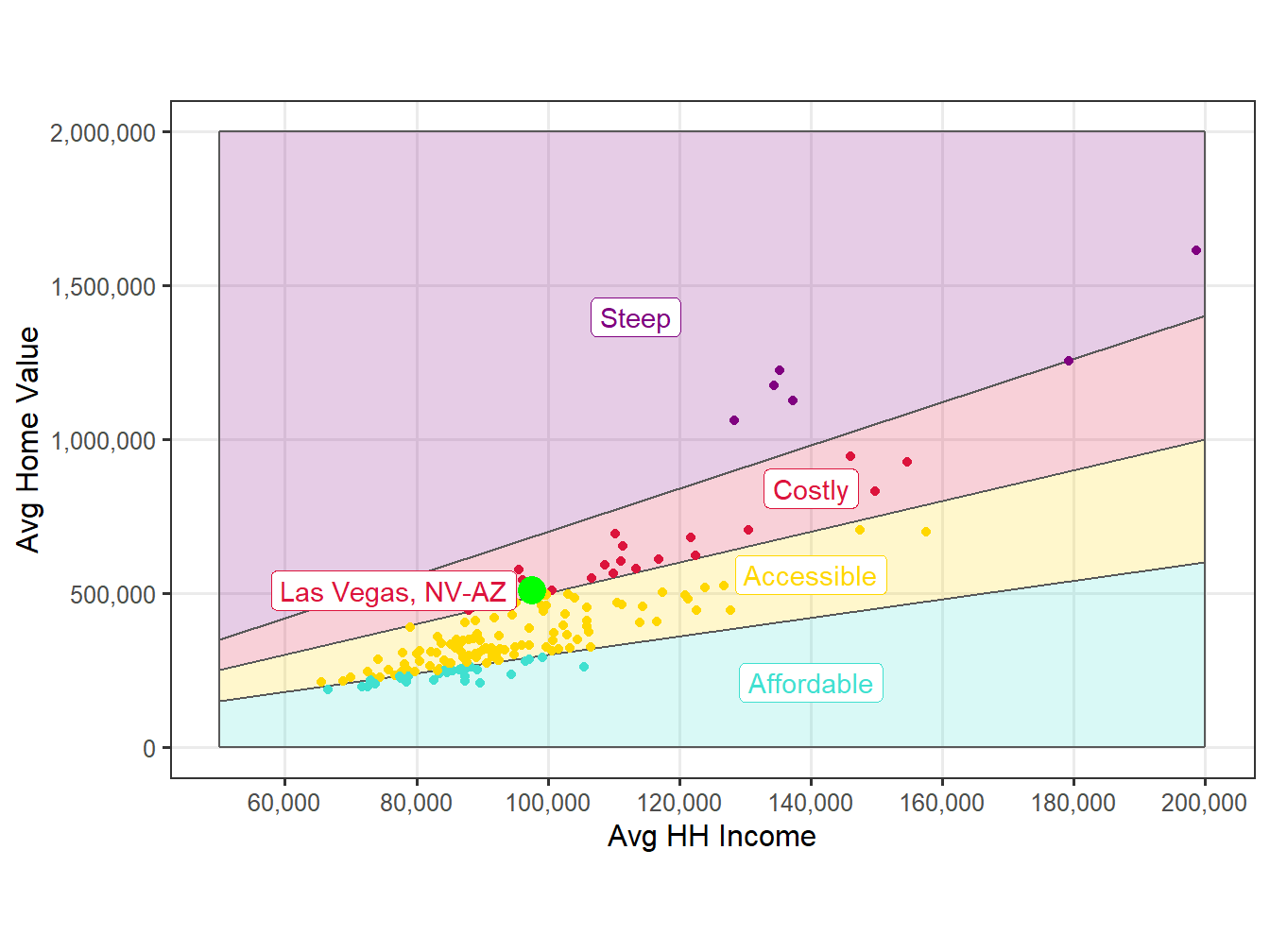

Affordability Level - Costly

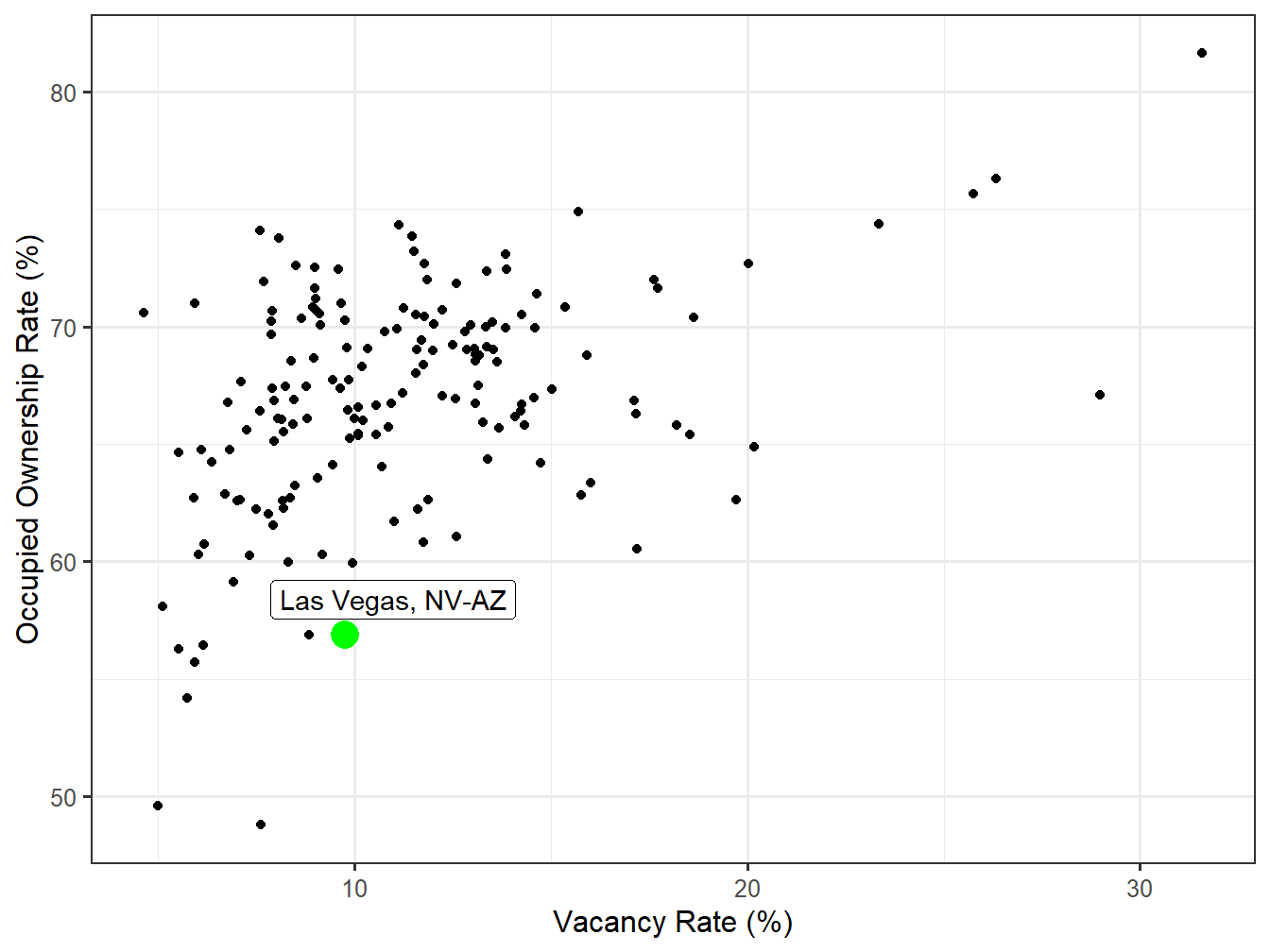

Overall Affordability can be classified in a similar fashion, comparing the Markets Average Home Value with the Average Household Income. This Affordability ratio currently sits at 5. The Las Vegas, NV-AZ Market therefore earns the Costly classification for housing affordability and ranks 16th across STI Markets. The following chart shows how markets compare between these two measure. Note the breaks between affordability classifications are 3, 5, and 7.

Figure 60: Affordability Comparision